US High Yield

Overview

- We still see investors being rewarded for taking carefully calibrated credit risk

- Historically, long carry strategies have been demonstrated to generate positive excess returns

- Credit fundamentals are consistent with default rates remaining subdued for now.

Search for yield

After a multi-decade bull run in interest rates and extraordinary measures taken by central banks to combat the most serious recession (and financial crisis) in living memory leading to historically low yields, positive real returns within the higher quality corners of the fixed income complex look difficult to come by. While we are certainly expecting the backdrop to become a little less friendly for higher quality bonds, provided inflationary forces remain broadly in line with central bank targets, we expect this normalisation to remain measured relative to past rate rising cycles.

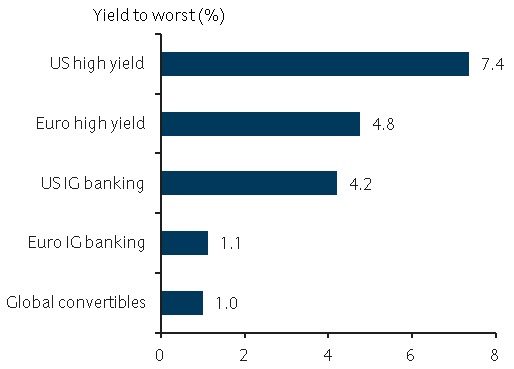

In such a context, we still see investors being rewarded for taking carefully calibrated credit risks (Figure 1).

Carry – a time-tested strategy

Historically, long carry strategies – that is, being long a higher yielding asset while being short a similar low yielding asset – has been demonstrated to generate consistent outperformance over time. Should the current credit conditions remain supportive, we would expect these carry strategies to outperform. With the ISM Manufacturing Index (our preferred lead indicator for the US business cycle) rebounding after an easing of momentum, we expect growth momentum to persist.

Default rates are expected to further decline after falling throughout 2018 and with lead indicators in the US still inconsistent with an imminent end to the business cycle, we still view thoughtful exposure to US high yield bonds attractive from a risk/reward perspective.

Current fundamentals

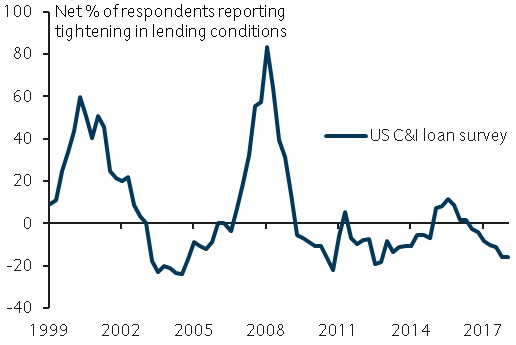

Looking at ratings, we note the credit quality of US high yield has slowly drifted higher over the past few years. Current lending standards, as measured by the Federal Reserve’s Senior Loan Officer Survey, are showing signs of easing (Figure 2) while the number of bonds trading at “distressed” levels is near all-time lows – both consistent with expected subdued default rates.

Borrower friendly conditions have fuelled a surge in “covenant-lite” debt, which has reduced the overall level of investor protection across the market. Whilst this is predominantly observed in the loan market, the growth of loan-only issuance might indicate lower recovery rates for high yield bonds as the latter typically sits below loans in a company’s capital structure. However, our view of the current economic backdrop and credit fundamentals means we don’t yet see cause for concern.

Risks

We note that long carry strategies are vulnerable to sharp near-term drawdowns when wider market conditions turn. High yield bonds tend to exhibit a higher frequency of ‘fat-tail’ losses in their return distributions, despite having better risk-adjusted returns than equities over the long term. Hence, this particular strategy is only suitable for investors with a high tolerance for drawdown risk. The other point worth noting is that due to the asymmetrical risk/return profile of bonds – particularly when choosing a carry strategy – means that avoiding the ‘losers’ can reap significant benefits.